audit vs tax salary

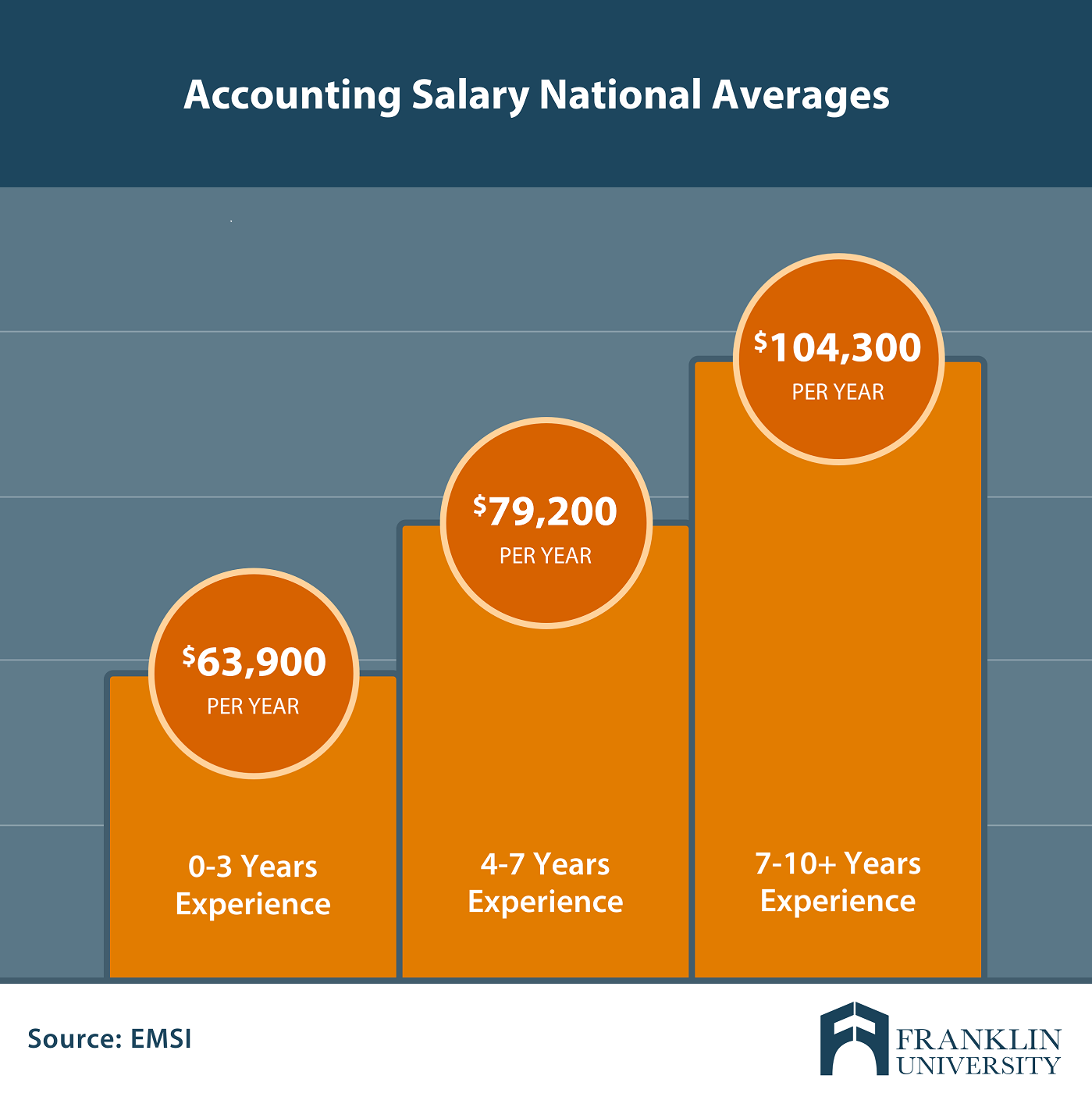

PwCs starting salary for advisory associates is 65000. Has a broader focus than tax.

Crow Shields Bailey Pc Accounting Students Should You Choose Tax Or Audit

Below is a tabularized representation of the differences between choosing a career in tax vs audit.

. Exposure to a wider range of industry financial reporting. Consulting is highest paying and probably most interesting depending on the specific type. Audit is so much broader and lets you do more with your career.

Taxes You may want. The starting salary at PwC is about 56000 for audit associates. Here are some of the differences between both options.

Where as auditors work in teams. Answer 1 of 3. Tax pays better but kind of pigeon.

Diversified industry experience to sell. Some sites state that lower level audit staff jobs are more. Audit is lowest paying but is a solidstable path to a good career.

The salary range for some of the largest employers. They work 40-45hrs a week and pull in nice salaries. If you do 2-3 years of audit at b4 you can get hired just about anywhere.

Tax might be a little higher since its more specialized. Your typical exit is F500 or IRS otherwise youre stuck in. Auditors work with clients from day one where.

You get great exposure to. Lets dive into the pros and the cons of deciding between tax vs. Salaries estimates are based on 19 salaries.

Audits are great areas to start off with. Filter by location to see an AuditTax salaries in your area. PwCs starting salary for tax associates is 62000.

The key difference between tax accountants and auditors is that tax accountants specialize in helping businesses and individuals plan for minimize and file taxes while auditors. Starting salary is similar. The national average salary for an AuditTax is 84413 per year in United States.

Tax you can get hired into any tax. In the US north west tax started about 10k 20 higher at. There is conflicting information from online sources regarding differences in pay for auditors vs.

The average salary for tax accountants based on a survey of 1641 respondents as of June 12 2011 was 34912 to 65595. The Big Four firms set the salary benchmarks for the profession and as of 2021 their salary range for new accounting and audit associates is between 40000 and 80000. Tax accountants typically work individually.

Its not rainmaker money but you have time to enjoy your life. Here in the US teachers are paid poorly in most states. Audit vs Tax Originally Posted.

Tax has a more specialized focus. Tax will pigeon hole you the more time you spend in tax the more you become the tax person no one will consider you. In my city starting salaries for tax are 3000 to 4000 more than audit.

Tax has far fewer exit opportunities than audit the longer you stay in tax the harder it is to take on non-tax roles without a large pay cut.

Operational Management Pacific Foundation Services

Audit Vs Tax The Accounting Major S Major Decision

Red Flags That Could Trigger A Tax Audit

Master S Degree In Accounting Salary What Can You Expect

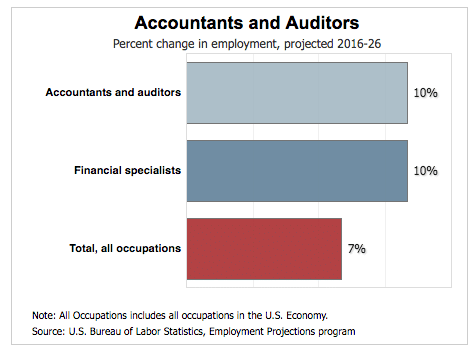

Audit Vs Tax Accounting Accountants And Auditors

Audit Or Tax Difference Between Audit And Tax Cpa Career Youtube

2022 Ey Guide To Salary Levels Pay Scale Compensation

Tax Form Of State Government Taxation With Forms Calendar Audit Calculator Or Analysis To Account And Payment In Illustration Stock Vector Illustration Of Credit Business 242206905

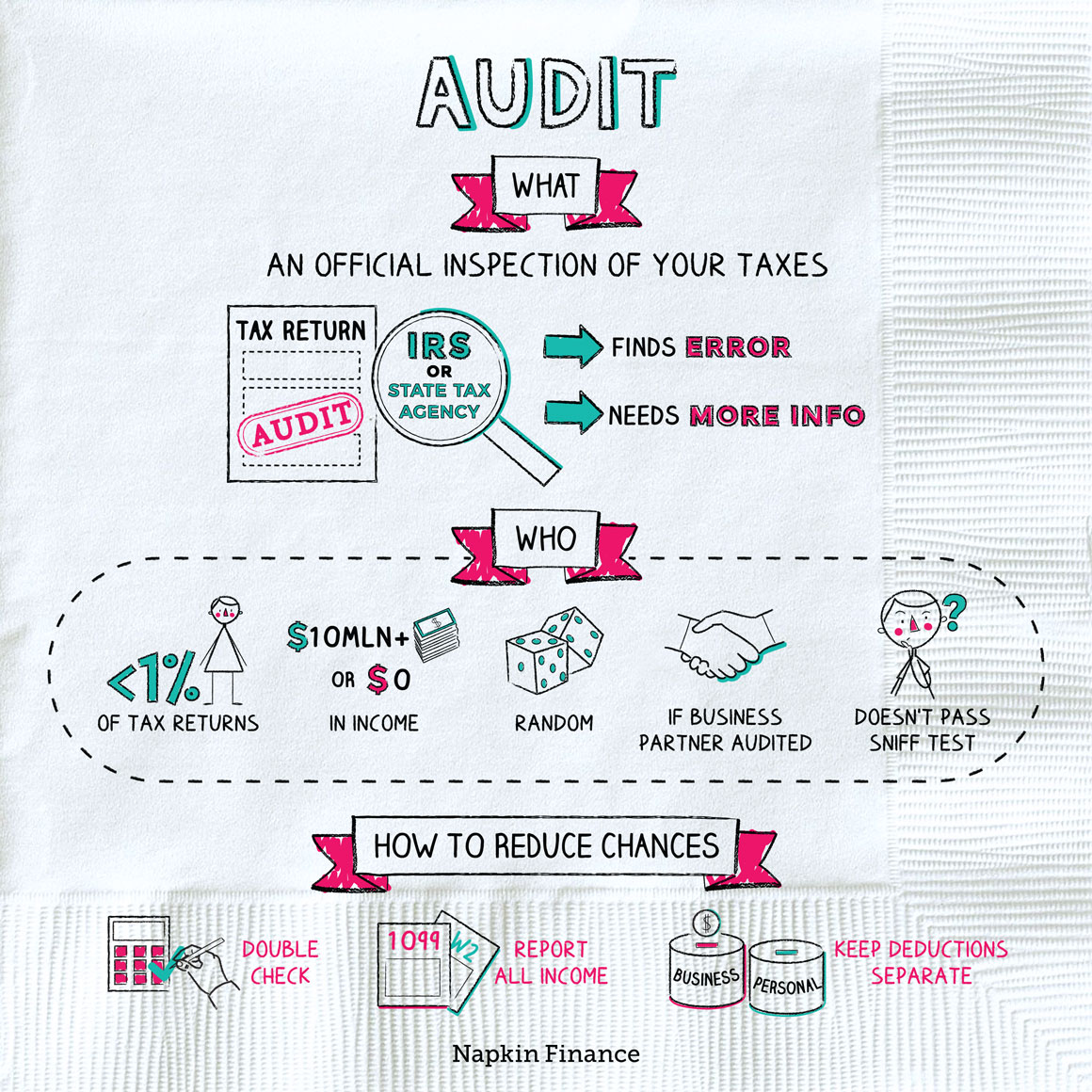

What Is Tax Audit Napkin Finance

Cpa Salary Guide 2022 Find Out How Much You Ll Make

Payroll Human Resources Auditing Youtube

New Jersey Nj Tax Rate H R Block

Tax Audit Definition Example Explanation And Types Wikiaccounting

Big 4 Accounting Firms Salary 2022 Which Has The Best Cpa Salary

Difference Between Audit And Tax Accounting The Big 4 Accounting Firms